How to Tilt Your Portfolio Toward Small Value Stocks

Small value stocks historically outperform.

Most investors who’ve recently gotten their feet wet know about index funds. By owning the entire market you can diversify away risks inherent in particular stocks. If one sinks, you have thousands of others to generate returns for your portfolio. Historically, the market portfolio, as it’s known, has beat inflation.

But investors get bored. And when they get bored, they often resort to foolish endeavors such as stock picking or investing in the latest shiny object, like crypto and innovative technology ETFs. None of these other paths to earning higher returns are evidence-based. Sure, some people have gotten lucky, but there are far more people that have lost money.

There is one investing style that deviates from the market portfolio, offering both greater diversification as well as additional return, and that’s value investing. These are the boring companies you never think to invest in that don’t “go to the moon” but provide reliable profits and returns over the years. They’re companies in the financial, energy and consumer goods sectors. They’re solid businesses you want in your portfolio but probably wouldn’t think to buy if you were playing around with some money in a sandbox brokerage account. Take value companies and isolate the smallest ones and you get a further source of return in your portfolio.

Size (that is, small) and value are the most well-known of the systematic risk factors in investing. I wrote about factor investing last year, but here’s a quick review.

A Review of Factor Investing

Factors are characteristics that help explain why some portfolios outperform others. These factors can include a variety of quantitative and qualitative factors such as size, valuation, profitability, and more. By identifying stocks with these factors, investors can tilt their portfolios toward them, potentially achieving better returns on their investments. For example, by adding more undervalued stocks (as defined by some metric like price-to-book or price-to-earnings) to a portfolio, an investor might achieve higher returns than had they simply held a market-weighted portfolio.

Going back decades, academic research has sought to identify factors that offered a premium above the return of the market portfolio and make the case for why they work.

The original factor — market beta — was distilled in the capital asset pricing model (CAPM) by William Sharpe in 1964. This factor measures the risk of a stock as defined by volatility. Then in 1992, Eugene Fama and Kenneth French proposed the Three-Factor Model and added the size and value factors. In 2014, they identified two additional factors: profitability and investment, in their revised Five-Factor Model.

There are hundreds more factors with varying evidence to support them, but the size and value factors are the most widely recognized with the most evidence to support them.

What the Research Says About Small Value Stocks

Fama and French’s 1992 research showed that small stocks outperformed large stocks and value stocks outperformed growth stocks. Through extensive research using historical stock data, they found that a model taking into account the size and value factors provided a better fit for explaining asset returns than the traditional CAPM. Their findings challenged the notion that market beta alone could fully explain variations in portfolio returns.

This was groundbreaking research and continues to influence how asset managers and individual investors design portfolios. Before, manager skill was often cited as a reason why some portfolios outperformed others. Factor research disproved this and allowed investors to more systematically implement factors in their portfolios.

There are a couple of explanations for why small value stocks outperform. The first is that the market is inefficient at pricing certain stocks. Small value investors can exploit these inefficiencies by loading up on these stocks. The second is that small value stocks are riskier. Most investors don’t want to take this risk, and therefore the investors who do take on the additional risk get rewarded. True believers in factor investing tend to accept the latter explanation.

How to Add Small Value to Your Portfolio

So how do you know which funds capture the factors you want? Well, there’s a great tool called Portfolio Visualizer.

Portfolio Visualizer does many things, but for our purposes, I want to highlight its factor regression analysis tool. This lets you run a stock, mutual fund or ETF through the tool to identify which factors they load positively or negatively on. To start, make sure you’re using these settings, which appear by default:

The tool defaults to the Fama-French Three-Factor Model, but you can also select the Five-Factor Model. You only need to add the ticker symbol you want to analyze.

For example, we can run the Vanguard Total Stock Market ETF (VTI) through the tool to get these results:

The numbers in the Loading column represent the sensitivity of the fund to a certain factor. A higher number suggests a fund is more sensitive. This lets you compare different value funds to figure out which ones load more heavily on the factors you want to target, like size and value. Because this is a total U.S. stock market fund, the market beta factor loading is about 1, and size and value are 0. When you own a market-cap-weighted portfolio, you gain exposure to this single factor.

There are other columns, but those are beyond the scope of this exercise.

The easiest and cheapest way to add the small and value factors to your portfolio is by simply buying a fund that tracks a small value index. The first that comes to mind is the Vanguard Small-Cap Value ETF (VBR). According to its Vanguard page, this fund “Seeks to track the performance of the CRSP US Small Cap Value Index, which measures the investment return of small-capitalization value stocks.”

When we run VBR through the regression analysis, this is what we get:

This fund loads more heavily on size and value, which is great. But if your goal is to tilt your portfolio, there are better options out there. Index funds can’t adequately capture the small value factor. For that, you need to look to funds that are a little more active. As opposed to traditional actively managed funds that rely on manager skill, these funds are run by managers that choose stocks by screening for factors. This allows the fund to invest in stocks based on the most recent price data as opposed to a static index.

Vanguard offers such a fund in the Vanguard U.S. Value Factor ETF (VFVA). The product page on Vanguard’s website tells us how the fund operates: “Advisor uses a rules-based quantitative model to evaluate U.S. common stocks.” The use of the term “quantitative” here tips us off that this is a more active value fund. To compare, here are the results of the factor regression:

This fund does have more mid and large-cap stocks, hence its weaker loading on size, but it has a much better loading on value.

My preferred method of capturing these factors, however, is through Avantis ETFs. Avantis is run by former employees of Dimensional Fund Advisors, one of the pioneers of small value investing. They are known for their rules-based approach to investing based on factors like size, value and profitability (one of the factors added in the Five-Factor Model).

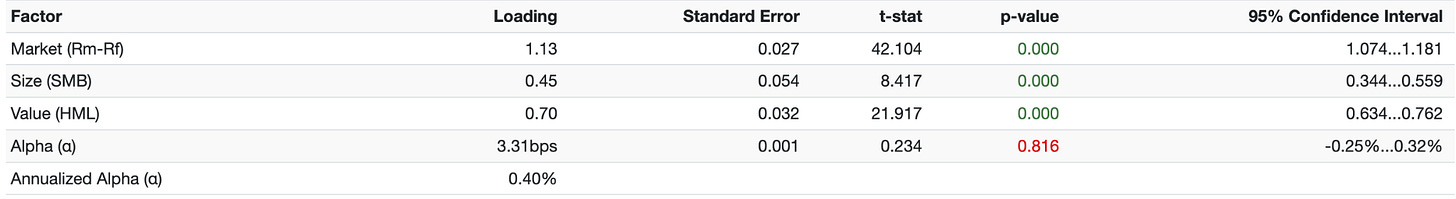

Their U.S. small-cap value fund, the Avantis U.S. Small Cap Value ETF (AVUV), loads even better on the size and value factors:

You can run a factor regression on any fund you might be thinking of adding to your portfolio to test how they load on different factors.

So how do you tilt your portfolio? You start with a market-cap-weighted portfolio and you add an allocation to your preferred value funds. How much is up to you. You could pick a conservative 10% tilt, a relatively aggressive 25% tilt, or go for 50% or more. There are no right answers but how much extra risk you’re willing to take.

Cautions Before Tilting

Many investors make the mistake of only focusing on the small part of small value. The reason this can be so problematic is due to the underperformance of unprofitable small growth stocks.

On the other side of value stocks are growth stocks. They focus on big ideas that may be realized in the future, and therefore they tend to be far less profitable in the short term. Sometimes this pays off, like with Amazon. But other times they crash and burn, like WeWork. Large growth stocks often present these risks, but that risk is even greater for small growth stocks. When investing in small-cap stocks, make sure you’re also considering valuation to keep unprofitable small growth stocks from dragging down your returns.

Small value investing doesn’t come without its challenges. This style of investing can go through long periods of underperforming the market. In fact, growth has beaten value on average for more than 12 years.

Growth advocates have argued for years that value investing is dead, but value investors believe that over time, the factor research will be vindicated. When growth stocks are flying to the moon, investors wonder why they should even bother. But that may be precisely the reason not to count out value from making a comeback. Just last year, value beat growth by the largest margin in years, renewing hope in the value strategy.

Small value investing offers patient investors a chance to give their portfolio an edge and potentially outperform the market over long periods. Unlike the shiny objects that have attracted retail traders in recent years, research shows value investing may win over time.

The question is whether you have the stomach to hold on during long periods of underperformance. But if you’re looking for a new strategy beyond owning the whole market, at least you can try an evidence-based approach.