Compound interest is one of those concepts that blows your mind the first time you learn about it. An apocryphal Albert Einstein quote called it the Eighth Wonder of the World. A proper understanding of it can change the way you look at your money.

Compound interest is what makes it possible for the average person to build wealth over their lifetime and retire comfortably. How much you’ll need when you retire depends on what your lifestyle is like now, what kind of lifestyle you want in retirement, where you live, inflation, and many more factors.

Conventional wisdom says you may need $1 to $2 million to maintain a middle class lifestyle in retirement, assuming you don’t have a pension and excluding Social Security. That can seem really scary if you’ve barely given retirement a thought. That amount of money might not feel attainable or even real to you. But it’s absolutely possible if you start early enough and understand what it takes to get there.

Simple v. Compound Interest

First, we need to understand simple interest. This is interest only on an original amount deposited or invested. Say you deposit $100 into a savings account that earns a 1% simple interest rate. At the end of the first year you would have $101. At the end of the second year you would have $102. That’s simple interest.

But interest in real life is almost always compounded, meaning you’re earning interest not only on the initial deposit, but all subsequent interest payments as well. Let’s say the bank pays you 1% interest on your $100 deposit compounded annually. At the end of the first year you would have $101. But at the end of the second year you would have $102.01, because you earned 1% of $101 rather than the original amount of $100. At the end of the third year, you’d have $103.03, and so on.

Think of it like this: You earn interest, and then your interest earns interest, creating a snowball effect that grows your deposit exponentially.

An Investing Example

We can apply this to investing. While past performance does not guarantee future results, the S&P 500 has returned roughly 10% on average since 1926. After inflation, your real returns might be more like 7% to 8%. Total stock market index funds deliver comparable returns to S&P 500 index funds, so they are interchangeable for the purpose of this example.

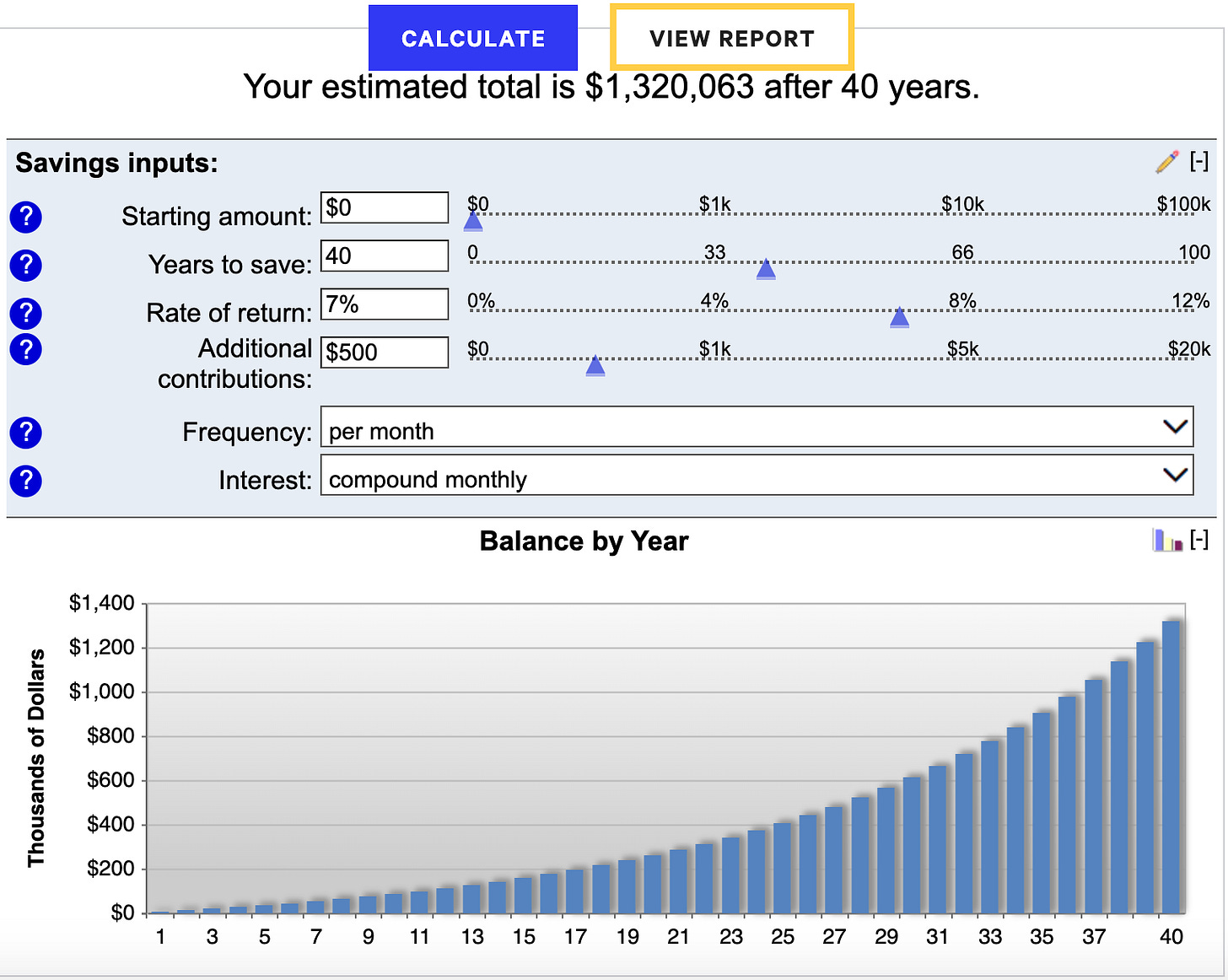

Let’s say from the time you are 25 you invest $500 a month — that’s $250 per paycheck if you get paid biweekly — and invest it in index funds inside a retirement account. You do this until you reach 65, after which you retire. Assuming a 7% average annual return, you would retire with $1,320,063.

Even though you only invested $240,000 of your own money, the gains you received from your investments, and the gains on those gains, results in a compounding effect over the years. In fact, around year 17, your investment gains begin surpassing your total principal invested.

Changing your assumptions — rate of return, how long you work, how much you invest each month — can have big impacts on your investment growth.

Let’s say you work five more years until 70. Your balance would then be $1,907,359. If you then invested $1,000 instead of $500 each month, you would end up with double, $3,814,718. What if instead of a 7% average rate of return your investments returned 8%? Then you would retire with $5,309,704.

These conditions aren’t going to be realistic for everyone, as some people get a late start, some people can’t invest that much, and others may get a lower return. And we do have to take inflation into account. But I hope putting it in these terms makes a goal like $1 million seem much more achievable over a lifetime.

How Starting Early Saves You Money

Starting early lets you take full advantage of the power of compounding. The later you start, the more money you’re going to have to put to work.

Imagine you have a retirement goal of $1 million in invested assets. Let’s compare how much money you would need to invest every month to reach that goal based on different starting points. Assume a 7% average rate of return and that our end point is age 65.

Age 20 - $265/month

Age 25 - $380/month

Age 30 - $555/month

Age 40 - $1,230/month

Age 50 - $3,200/month

Age 60 - $14,000/month

As you can see, the longer you wait, the more you have to invest. Those who start early enough can invest relatively modest amounts and compound interest will do most of the heavy lifting.

The Rule of 72

The Rule of 72 is a handy tool that shows you how long it will take money to double given a certain rate of return. You simply divide 72 by the rate of return to find out this number. Let’s say you start with $1,000 and earn a 7% annual return. Using the Rule of 72, we divide 72 by 7 to get 10.28 years, meaning your money will double to $2,000 in 10.28 years.

Assuming you maintain a 7% average return, your money will double again to $4,000 after another 10.28 years. At an 8% rate of return your money will double every 9 years. At a 9% rate of return it will double every 8 years. At a 10% rate of return it will double every 7.2 years. And so on.

How Compound Interest Can Work Against You

Compound interest can also work against you. Credit card interest rates can range from 12% to 24%. If you can see how powerful an effect on growing your wealth just 7% has over a few decades, imagine the negative compounding effect a 24% interest rate on a credit card can have if you accumulate debt.

Investment fees can also play a role in reducing your wealth. If you’re investing in index funds like the ones from Vanguard, you don’t have to worry about fees playing a big role, as these typically range from 0.03% to 0.08%. But many actively managed funds still charge fees of about 1% or higher. Paying 1% in fees over your lifetime may not seem like a lot, but it can easily add up to hundreds of thousands of dollars lost.

Conclusion

Compound interest is one of the most powerful tools you have working in your favor as an investor, second perhaps only to your savings rate. If you understand how it works and invest early and intentionally, you can put yourself in a strong financial position in the future. Even if you are getting a late start in life, the best time to invest is still now.